Convertible Bondholders Have the Right to Convert Their Bonds to

You may be surprised about what you read. I research topics about bondholders to support my answer.

Retirees beware of this conventional wisdom.

. 9 hours agoThe Issuer and the Company propose to invite the Bondholders to submit Conversion Notices to convert their holdings of the Convertible Bonds into Shares at any time between 430 pm. For example if a convertible bond has a conversion ratio of 51 the bondholder can convert the bond into five shares of common stock. The quantum and value of shares are predetermined at the time of issue in the offer document.

Convertible bonds are usually fixed-rate bonds that give their holders the right to convert their bonds to another instrument. If share prices increase Bondholders can exchange the bond for a specific number of shares of issue company. What action are bondholders likely to take O Bondholders will most likely convert their bonds to shares of.

Status of the bond. In addition these bonds give the bondholders the right to convert their bonds at a specified future date into new equity shares of the company at a conversion rate as specified when the bonds are issued. Has convertible bonds outstanding that are callable at 1055 The bonds are converts into 25 shares of common stock The stock is currently selling for 6220 per share a.

A convertible bond also has a conversion price. After converting the bond into stocks the bondholder becomes a shareholder and gets all the rights and benefits that come with it. Convertible bonds allow the bondholder to convert their bonds into a predetermined number of stocks.

These are the most common type of convertible bonds. Convertible bonds can be described as hybrid security as it provides the features of both debt and equity. This instrument is usually common stock but can be another debt or equity instrument of the issuer.

It gives bondholders the right to exchange the bond for a specified number of common shares in the issuing company. In convertible bonds bondholders get a right to convert their bonds for a specific number of shares of the bond issuer. If bondholders choose not to convert their bonds into shares the bonds will be redeemed at maturity usually at par.

This bond gives the purchaser a right or an obligation to convert the bond into equity shares of the issuing company. Convert into 287411381 Brait ordinary shares 2218 of Braits current issued share capital excluding treasury shares. Whereas a reverse convertible bond has an embedded put option that gives the issuer the right to convert the bonds principal into shares of equity at a set date.

Investors are granted the right to convert their bonds to a certain number of shares at a predetermined conversion price and rate at the maturity date. If the firm announces it is going to call the bonds at 1055. Convertible bond is a hybrid security with both debt and equity features referred to as hybrid security.

Typically the convertible bonds are fixed-rate bonds that have a coupon rate of interest lower as compared to on similar conventional bonds. Convertible bondholders are not obligated to convert their bonds to common stock but they may do so if they choose. Ad Learn why conservative investing might not be as safe and prudent as it sounds.

In the event that bondholders have not exercised their conversion rights the 2024 Convertible Bonds are cash settled at par value on settlement date. A convertible bond is a hybrid debt instrument that has the features of both equity and debt components. Hong Kong time on 28 April 2022 subject to early closure where the Maximum Acceptance Amount is reached prior to.

Hong Kong time on 25 April 2022 and 300 pm. Meanwhile reverse convertible bonds give the issuer the right but not the obligation to convert the bonds principal into shares of equity at a set date. Convertible bonds give bondholders the right to convert their bonds into another form of debt or equity at a later date at a predetermined price and for a set number of shares.

A convertible bond has an embedded call option that gives bondholders the right to convert their bonds into equity at a given time for a predetermined number of shares in the issuing company. Although convertible bonds have the same benefits of ordinary bonds they also include the right of the bondholder to convert their investment into a predetermined number of shares in the company at a preset conversion price as stipulated in the convertible bonds terms. Conversion privilege Financial Management.

35 Bondholders will convert their convertible bonds into shares of stock only when the conversion price is greater than the market price of the stock. View the full answer Previous question Next question. Expert Answer The answer is B- Market Value of the Stock A convertible bond gives the bondholder the right to convert the bond into a fixed number of shares of common stock in the issuing company.

The conversion price is based on the conversion ratio. A convertible bond has an embedded call option that gives bondholders the right to convert their bonds into equity at a given time for a predetermined number of shares in the issuing company. This privilege allows bondholders to take advantage of favorable movements in the price of the issuers shares.

FALSE The answer is false. Convertible bonds give the holders the right but not an obligation to convert their bonds at a specified future date into new equity shares of the company at a conversion rate that is also specified when the bonds are issued. The answer is given but I checked the question and analyze to make it sure if it is true.

The bonds conversion ratio tells the bondholder how many common shares each bond can be converted to. The conversion feature is analogous to a call option that has been attached to.

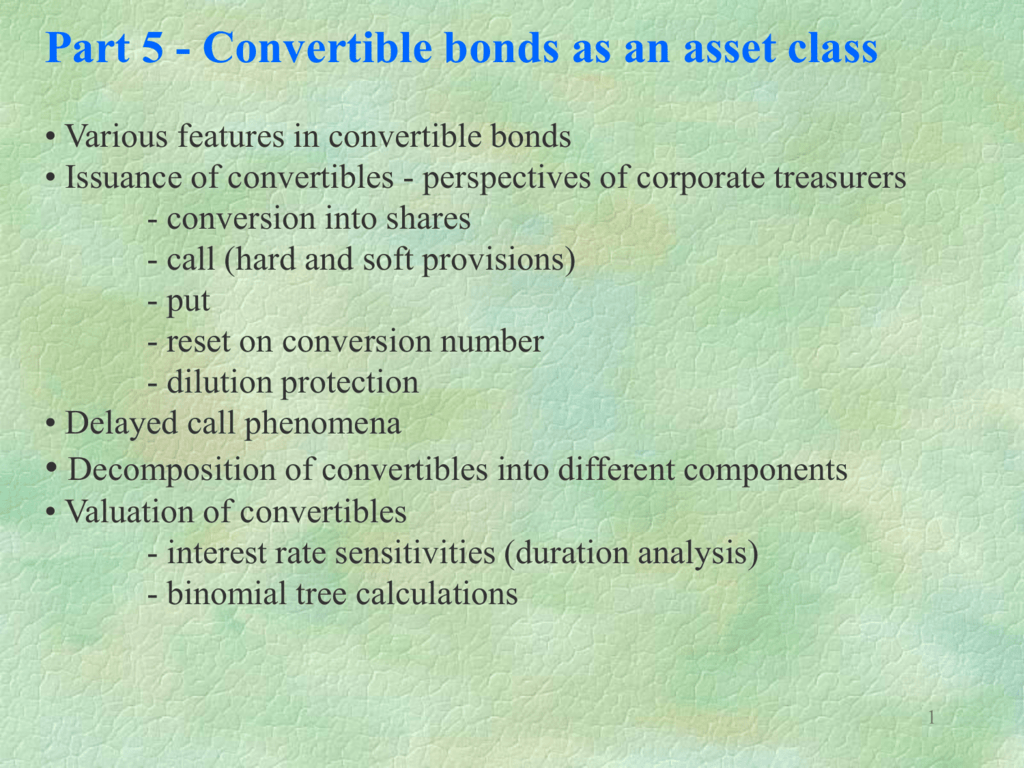

Fixed Income Securities Abn Amro

Equity Convertibles Why Timing Matters The Association Of Corporate Treasurers

Convertible Debt And Shareholder Incentives Sciencedirect

Convertible Bonds Primer On Conversion Features

Convertible Bonds Facts To Know

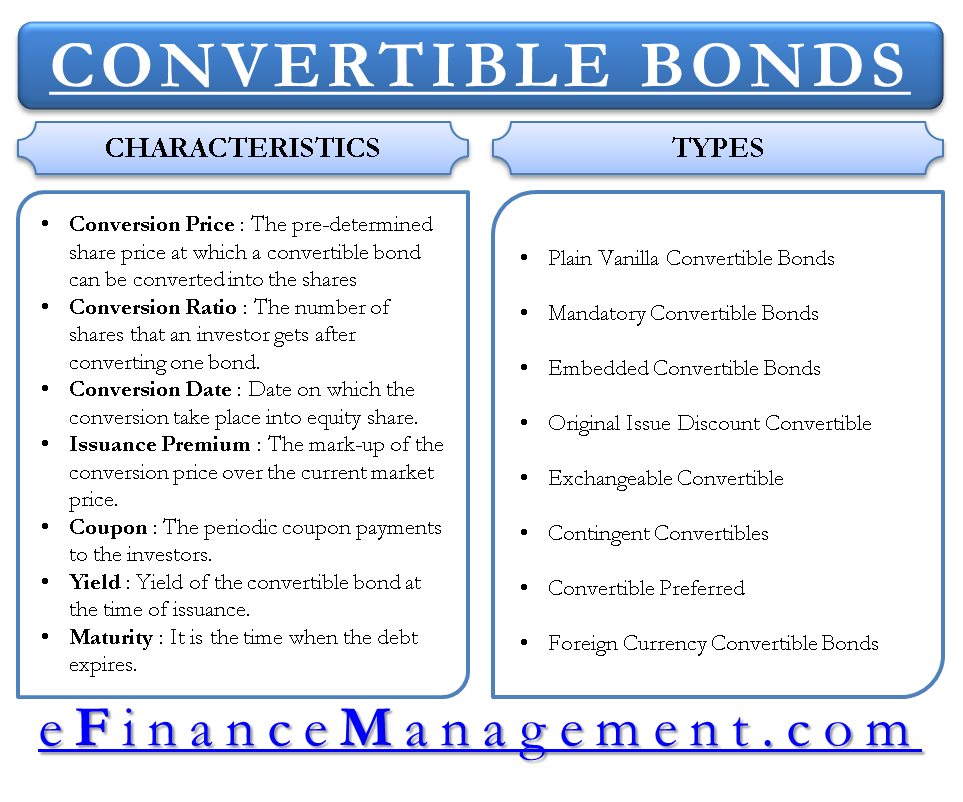

Convertible Bonds Efinancemanagement

Learn Quiz On Bankers Acceptance Financial Markets Quiz 48 To Practice Free Financial Marke Trivia Questions And Answers Online Trivia This Or That Questions

What Are Convertible Bonds Learn More Investment U

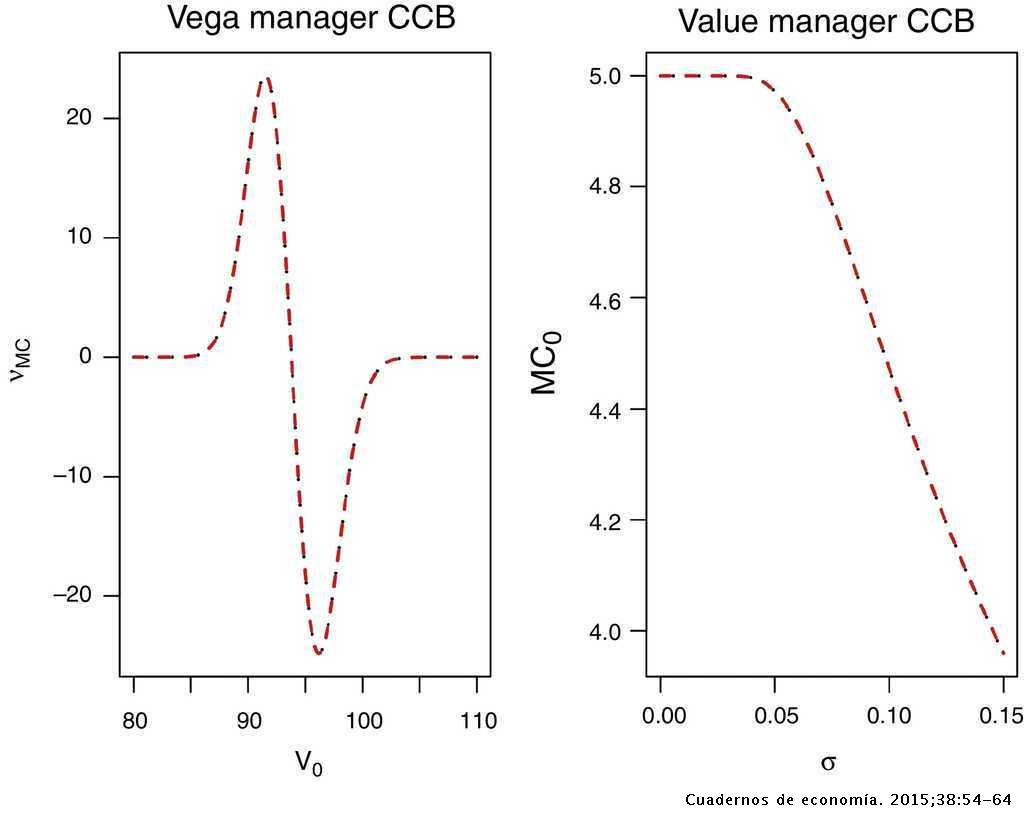

Contingent Convertible Bonds And Their Impact On Risk Taking Of Managers Cuadernos De Economia

Pdf Valuing Convertible Bonds A New Approach Semantic Scholar

Pdf Valuing Convertible Bonds A New Approach Semantic Scholar

Characteristics Of Bonds Quizzes Financial Markets Quiz 16 Questions And Answers Prac Trivia Questions And Answers Quiz Questions And Answers Online Quiz

Financing Decisions The Case Of Convertible Bonds Sciencedirect

/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

/GettyImages-1027438182-eaf939c9f7d245e98ae6f5b385ac1488.jpg)

Comments

Post a Comment